- #HOW IS OWNERS PAY AND PERSONAL EXPENSES IN QUICKBOOKS TAXED HOW TO#

- #HOW IS OWNERS PAY AND PERSONAL EXPENSES IN QUICKBOOKS TAXED PLUS#

Distributions that are paid out after that are considered after-tax and are taxable to the owners that receive them. Do owner distributions count as income Dividends come exclusively from your business’s profits and count as taxable income for you and other owners. It will be closed at the end of the year to the owner's capital account. Instead, you pay income tax and self-employment tax on your portion of business earnings, regardless of the amount you draw from the business. This is a temporary account with a debit balance. The contra owner's equity account used to record the current year's withdrawals of business assets by the sole proprietor for personal use. Owner's equity is viewed as a residual claim on the business assets because liabilities have a higher claim. For example, if the profits of the S corp are 100,000 and there are four shareholders, each with a 1/4 share, each shareholder would pay taxes on 25,000 in profits.

#HOW IS OWNERS PAY AND PERSONAL EXPENSES IN QUICKBOOKS TAXED PLUS#

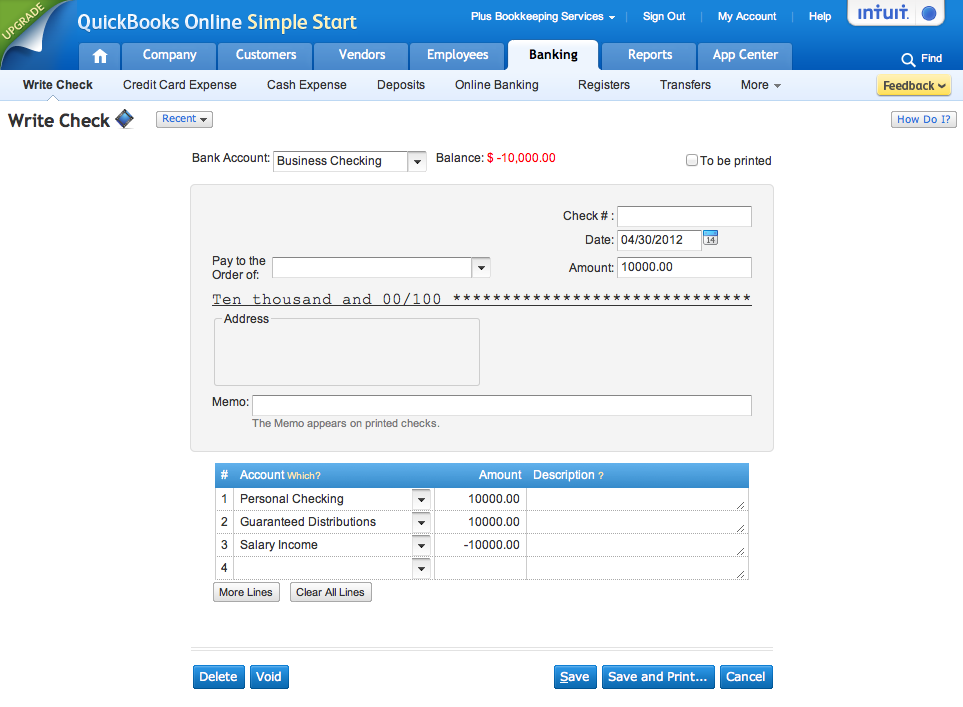

Owner's equity represents the owner's investment in the business minus the owner's draws or withdrawals from the business plus the net income (or minus the net loss) since the business began. The owners of the S corp pay income taxes based on their distributive share of ownership, and these taxes are reported on their individual Form 1040. So your chart of accounts could look like this. When you put money in the business you also use an equity account. One may also ask, what is owner's draw vs owner's equity in Quickbooks? Owner draw is an equity type account used when you take f Owner draw is an equity type account used when you take funds from the business. Sole proprietorships and partnerships don't pay taxes on their profits any profit the business makes is reported as income on the owners' personal tax returns.

Similarly, it is asked, is owner's draw an expense or equity?Īn owner's drawing is not a business expense, so it doesn't appear on the company's income statement, and thus it doesn't affect the company's net income. Business owners can withdraw profits earned by the company. This is called an owner investment (and in Kashoo, there is an account called contributed capital that can be used to track these funds).You would use this account when you transfer money out of the business bank account to a personal bank account or to pay for a personal expense. You can pay your taxes online by clicking Pay Taxes in the left corner of the page. Taxes can be paid by clicking on Pay Taxes. For an LLC, you can do the same in your journal and then show under your expenses account that repayment as Owed to Owner.

#HOW IS OWNERS PAY AND PERSONAL EXPENSES IN QUICKBOOKS TAXED HOW TO#

Where do I see records of income tax returns tax returns refund in quick books Select Payroll Tax from Taxes. This article tells you exactly how to set up Quickbooks payroll for a better payroll system. Another way to reflect this in your bookkeeping journals is by debiting those business expenses paid personally and then crediting them under the liability account as Due to Owner. Owner's equity is made up of different funds, including money you've invested into your business. Helping business owners for over 15 years. Owner's draws are usually taken from your owner's equity account. Business owners might use a draw for compensation versus paying themselves a salary.

0 kommentar(er)

0 kommentar(er)